Asia Pacific Leads Fastest Growth in Global Table Wine Market | Garner Insights 2025

Asia Pacific, driven by China and India, is the fastest-growing region in the global table wine market. See how evolving tastes and rising incomes boost demand.

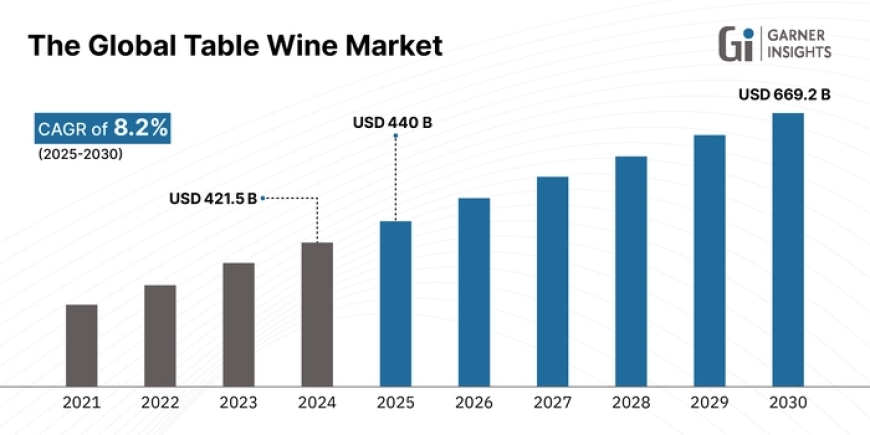

Global Table Wine Market Projected to Reach USD 669.2 Billion by 2030 Driven by Premiumization, E-commerce Growth, and Health Trends

July 3, 2025 | Garner Insights

The global table wine market, valued at USD 421.5 billion in 2024, is forecast to expand to USD 669.2 billion by 2030, growing at a CAGR of 8.2% during 2025-2030, according to the latest report from Garner Insights.

Fueled by rising consumer demand for premium and terroir-driven wines, increasing health-consciousness, and a surge in digital sales channels, the table wine sector is witnessing dynamic growth worldwide. While Europe remains the dominant producer and exporter, fast-growing markets in North America and Asia Pacific are reshaping the global landscape through evolving preferences and higher disposable incomes.

Key Highlights

-

Market Size: USD 421.5 billion (2024) ? USD 669.2 billion (2030)

-

Premiumization: High-end varietals such as Barolo, Napa Cabernet, and Burgundy Pinot Noir gain traction as lifestyle symbols

-

Online Sales: E-commerce and direct-to-consumer (D2C) platforms contribute roughly 30% of revenue in mature markets

-

Health Trends: Growing demand for low- and no-alcohol wines, organic and biodynamic labels

-

Fastest-Growing Region: Asia Pacific, led by China and Indias expanding consumer base

Market Dynamics

Growth Drivers

-

Premiumization & Terroir: Consumers increasingly pay a premium for wines with strong provenance and authenticity, supported by regulatory appellations and fine dining trends.

-

E-commerce Boom: Online platforms, subscription clubs, and virtual tastings drive new customer acquisition and retention globally.

-

Health & Wellness: Shift towards low-alcohol, antioxidant-rich wines and sustainable production appeals to younger, health-conscious demographics.

Market Restraints

-

Health & Regulatory Pressures: Declining consumption in some regions due to moderation trends and stricter labeling/taxation policies.

-

Compliance Costs: Rising production costs linked to sustainability requirements and regulations impact price flexibility.

Emerging Opportunities

-

Functional Wines: Development of no/low-alcohol and functional ingredient-infused wines by brands like FitVine and Treasury Wine Estates new NOLO facility.

-

Digital Innovation: Blockchain for traceability and personalized D2C experiences boost consumer confidence and engagement.

Regional Analysis

North America

Market Size: USD 147.5 billion (2024)

Leading in premiumization and e-commerce penetration, supported by favorable regulations and strong wine tourism hubs.

Europe

Market Size: USD 126.5 billion (2024)

Home to rich wine heritage with strong production and export infrastructure; accelerating digital sales and sustainability initiatives.

Asia Pacific

Market Size: USD 84.3 billion (2024)

Fastest-growing market, driven by China and Indias rising middle class, urbanization, and shifting preferences towards diverse varietals.

Latin America

Market Size: USD 42 billion (2024)

Growth backed by production leadership in Argentina and Chile, expanding export opportunities and rising domestic premium consumption.

Middle East & Africa

Market Size: USD 21 billion (2024)

Niche markets driven by South African production, tourism, and evolving consumption despite regulatory challenges.

Company Market Share & Leadership

The global table wine market is dominated by a mix of established legacy producers and innovative players focused on premiumization and digital transformation.

-

Treasury Wine Estates: Market leader with brands like Penfolds and Yellow Tail, emphasizing sustainability and D2C platforms.

-

Constellation Brands and Pernod Ricard: Major players leveraging global portfolios and digital expansion.

-

Accolade Wines/Vinarchy: Emerging global entity post-merger, focusing on premium assets like Jacobs Creek.

Recent Developments

-

April 2025: Treasury Wine Estates acquired Stone & Moon winery in Chinas Ningxia, advancing local production strategy.

-

June 2025: Vinarchy announced a AUD 30 million Barossa Valley expansion to create a centre of excellence for premium and sparkling wines.

-

October 2024: White Castle Vineyard (Wales) launched a new winery facility enhancing quality control and production capacity.

Read more here - https://garnerinsights.com/report/table-wine-market-size

![Top 11 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.philadelphialivenews.com/uploads/images/202506/image_430x256_68621a9e48997.jpg)