Transform Your Back Office Operations With a Mutual Fund Software for Distributors

The latest mutual fund software for distributors in India is like having a smart partner by your side. It helps you manage everything in one place, keeps your client data organized, and gives you a clear view of your business in real time. Whether it’s tracking investments or staying connected with clients, this software helps you do it faster, better, and with confidence.

Transform Your Back Office Operations With a Mutual Fund Software for Distributors

To manage the wealth of so many clients requires you to smoothly run your business, and how well you take care of your clients. As an MFD, your day is packed with handling client portfolios, tracking many investment products, and staying on top of regulations. It can get overwhelming.

Thats where the right technology makes all the difference.

The latestmutual fund software for distributors in Indiais like having a smart partner by your side. It helps you manage everything in one place, keeps your client data organized, and gives you a clear view of your business in real time. Whether its tracking investments or staying connected with clients, this software helps you do it faster, better, and with confidence.

Control, Customization, and Client Confidence

Imagine a system where you, as the distributor, decide exactly what your back office employees see and manage. This level of control is not just a convenience, its a necessity. With todays MF software, MFDs can enable the display of recent transactions and other modules for employees directly from the dashboard.

This allows for improved internal efficiency and better data privacy, especially when handling large teams. More importantly, it strengthens client trust, knowing their sensitive information is only visible to those authorised.

Not only that, but this customization also empowers MFDs to allocate tasks smartly and efficiently. Need one employee to handle only insurance and another for equities?

Just toggle the access, it's that simple.

Heres how you can manage access:

Path to Update Access Control: Utilities > Employee Master > Create/Update Employee > Access Control

By using mutual fund software for distributors, you dont just manage a team, you manage an entire business ecosystem from a single screen.

Features That Serve You Better

What sets these MutulFundSoftware solutions apart is their flexibility. Whether you are an independent distributor or managing a larger MFD setup, having many services integrated in one place changes the game.

Here are some powerful features you can enable through the dashboard:

? Mutual Funds Track, transact, and manage portfolios effortlessly.

? Life Insurance & General Insurance (GI) Handle policy renewals, quotes, and claims smoothly.

? Fixed Deposits (FDs) Get visibility on client FDs and renewal dates.

? Goal GPS Help clients visualize and achieve their financial goals.

? Wealth Reports Share consolidated reports with real-time data.

? Equity & Commodities Manage equity investments with live data feeds.

? Real Estate Tracking Add and track real estate investments in one dashboard.

? Financial Planning Tools Build, customize, and share goal-based financial plans.

? Invest Online Enable clients to invest directly from your portal or app.

With all these services in one software, you're not just distributing funds, youre building holistic financial futures for your clients.

Why Todays MFDs Need Smart Software?

Lets face it, manual data entries, fragmented spreadsheets, and scattered client communication are no longer sustainable. Clients expect instant responses, transparent reports, and 24/7 portfolio visibility. Software addresses these pain points in a way no traditional tool can.

More importantly, MFDs who uses technology enjoy:

? Increased Efficiency: Automate routine tasks like SIP tracking, NAV updates, and transaction reports.

? Better Compliance: Always stay audit-ready with well-maintained digital logs.

? Higher Client Satisfaction: Quick turnarounds and clear insights build lasting trust.

? Business Scalability: With less time on admin work, focus more on client acquisition and servicing.

How MFDs Can Use Access Control Effectively?

One of the most underrated yet powerful features in wealth management software is access control. Whether you're onboarding new staff or restructuring roles, giving the right access helps you protect sensitive data and assign roles smartly.

For example:

Give back-office staff access to update KYC or generate reports.

Limit junior employees to only viewingnot editingportfolio details.

Assign senior employees the ability to manage goal planning and insurance policies.

With simple navigation through the module, you get complete command over who sees what, which improves security and accountability within your team.

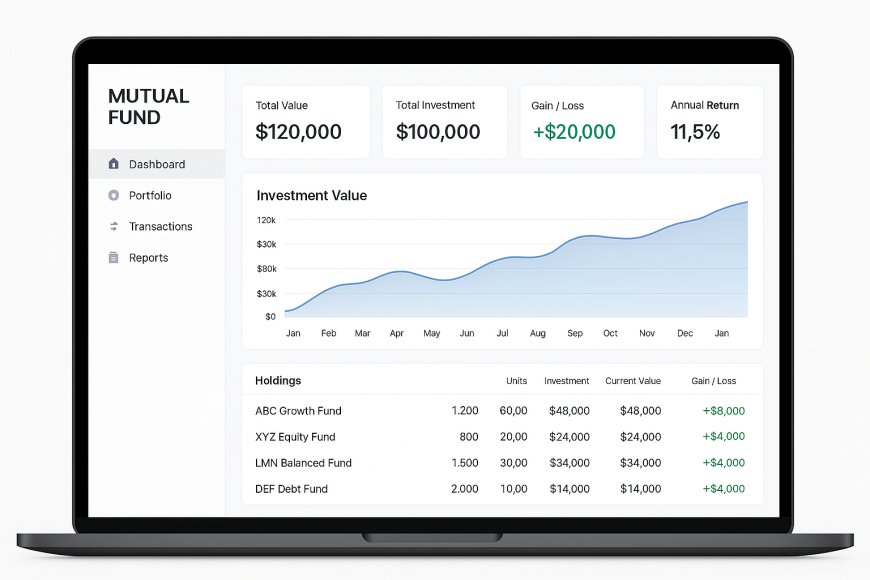

Smart Dashboards for Smarter Decisions

The dashboard isn't just a visual aid, its your command centre. A good software interface offers:

Real-time portfolio analytics

Reminders for renewals and SIPs

One-click access to client reports and transaction history

Instant goal tracking updates

When your business is this organized, client meetings become more about building relationships and less about pulling data.

Conclusion:

At its core, the purpose of adopting smart software is to offer better value to your clients. With real-time updates, integrated services, and faster turnarounds, clients feel more engaged and confident in their investments. And for you, this means stronger relationships, higher retention, and more referrals. By using one dashboard to manage everything, from insurance and FDs to equities and goal-based planning, you position yourself not just as a fund distributor but as a complete financial professional. So if youre looking to grow your practice, reduce operational clutter, and deliver more value to clients, the path forward is clear, embrace the technology built specifically for you.

![Top 11 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.philadelphialivenews.com/uploads/images/202506/image_430x256_68621a9e48997.jpg)